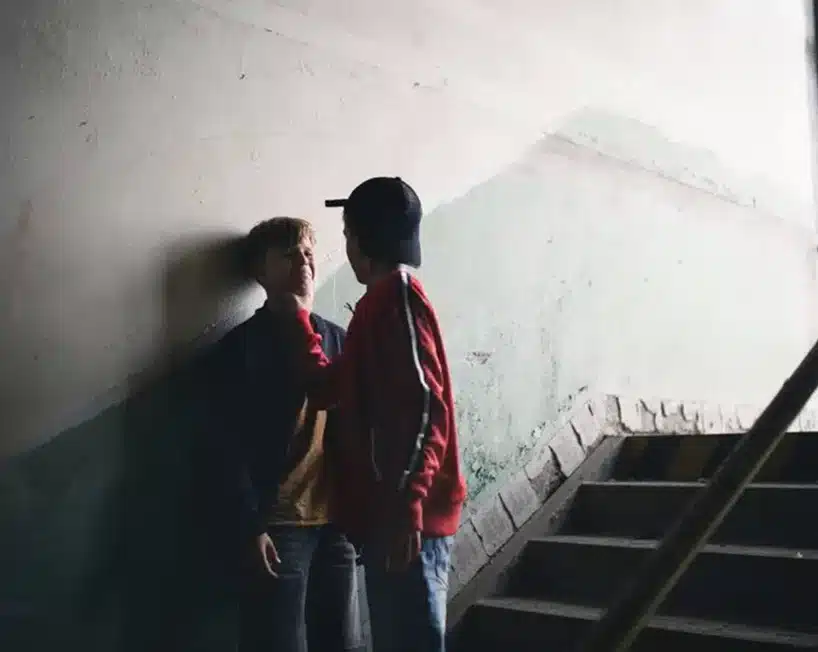

Feeling bullied by insurance claims adjusters can leave you feeling powerless and unsure of how to proceed with your claim. This is a tactic they might use to their advantage, but you have the power to turn the tables. Our guide addresses the pressing concern of being pushed around by adjusters, providing you with the know-how and resources to assert your rights and reach the fair settlement you deserve, so you don’t settle for less than you are entitled to.

In this article, we will also cover the common tactics insurance adjusters use to minimize payouts, helping you recognize and effectively challenge these strategies.

Expect insights and expert advice on every aspect—from recognizing manipulative tactics to when it’s time to seek legal help.

Key Takeaways

- Recognize insurance adjuster tactics to minimize payouts, including making low settlement amount offers, such as pressuring for quick settlements, questioning injury severity, and using surveillance, and counter them by setting communication boundaries, having comprehensive medical records, and protecting your privacy.

- Understand your rights against insurance adjuster harassment, including bad faith insurance laws and reporting unethical behavior to state insurance departments or regulatory authorities to ensure fair handling of your claim.

- Make informed decisions during negotiations to avoid accepting less than you are owed.

- Consider hiring a personal injury lawyer to navigate complex legal processes. These lawyers often work on a contingency fee basis, ensuring legal representation without upfront costs and financial accessibility in pursuing fair compensation.

Understanding Insurance Adjuster Tactics

Many insurance adjusters are adept at reducing the amounts paid out in settlements, utilizing numerous approaches to lessen their financial obligations. Protecting yourself and ensuring a fair settlement starts with understanding these methods. You may encounter adjusters who push for a speedy resolution, cast doubt on the extent of your injuries, or resort to surveillance to compile evidence that could undermine your claim.

An insurance claims adjuster is responsible for investigating, evaluating, and settling claims, often with the goal of minimizing payouts. The tactics employed by insurance adjusters have tangible effects on individuals regularly. By grasping these maneuvers, you equip yourself with the knowledge to predict their actions and defend your entitlements. We must explore their strategies and discuss practical ways to counteract them.

Recognizing Pressure Strategies

One standard tactic adjusters use is to pressure claimants into settling quickly. They might contact you soon after an incident, offering a settlement, which may be a lowball offer, before you have had the chance to assess the value of your claim fully. This is often accompanied by a sense of urgency, suggesting that the offer is only available for a limited time.

Restricting the duration and extent of your interactions with adjusters is vital in countering this pressure. Set clear boundaries and avoid detailed discussions about the accident or your injuries until you completely understand your situation. Be cautious about accepting a lowball offer from the adjuster before you fully understand the value of your claim. This approach helps avoid hasty settlements that fail to represent your claim’s actual value.

Questioning Injury Severity

Insurance adjusters may attempt to trivialize the extent of your injuries following a car accident to depreciate your claim’s worth. They might suggest that ‘minor impact’ could not result in significant injury, insinuating that small amounts of vehicle damage indicate slight or nonexistent personal injuries. This strategy is designed to cast doubt on your integrity and the validity of your personal injury case. Adjusters may also scrutinize your medical bills, arguing that your treatment was unnecessary or excessive, in an effort to minimize the payout for your claim.

To counteract this approach, avoid giving detailed accounts of your injuries right after experiencing fall accidents. Instead, state that you are still undergoing evaluation for those injuries. It is crucial to have comprehensive medical documentation supporting the severity of your condition since these records serve as solid proof regarding the magnitude of a person’s physical damages.

In such instances, restrain from conveying exact hurt narratives immediately succeeding slippages. Cite ongoing evaluations instead. Crucially possess exhaustive health-related attestations substantiating alleged corporeal distress level.

Surveillance and Privacy Intrusion

Insurance adjusters may use surveillance practices, including scrutinizing your online presence or enlisting private detectives to observe and document your daily activities. They aim to discover evidence that refutes the severity of your injuries as claimed. Such proof could encompass photos or videos showing actions that might undermine the legitimacy of your injury assertions.

It’s wise to be vigilant with what you share digitally to shield yourself effectively against such strategies by insurance companies. To aid in maintaining confidentiality and thwarting attempts by adjusters to invalidate your claim, consider these guidelines:

- Do not discuss specifics about personal pursuits, injuries sustained, or details related to the accident on Internet platforms.

- Exercise discretion when participating in digital discussions, such as forums and comment sections under blog posts.

- Restrict strangers’ access to personal content through stringent social media privacy settings adjustments.

- Be selective about who you allow into your network. Think carefully before confirming new friend requests or connections, especially if they come from individuals who are unknown personally.

Make it a habit to regularly check and refresh privacy configurations so they are current and protect user information according to their intended purpose.

Adhering strictly to these recommendations can help maintain strict control over one’s internet trail, thus securing integrity associated with one’s compensation pursuit following an unfortunate incident. Additionally, be aware that adjusters may use phone calls to probe for information or inconsistencies in your account, so exercise caution with what you share verbally.

Your Rights Against Adjuster Harassment

Do not feel defenseless in the face of forceful adjuster strategies. There are legal safeguards in place to defend you from unjust methods. Insurance companies are legally required to act in good faith when handling your claim, meaning they must deal with you honestly, fairly, and ethically. Knowing your legal rights empowers you to withstand intimidation and ensures your claim is processed ethically.

Understanding Bad Faith Insurance Laws

Insurance bad faith laws protect consumers from the evil actions of insurance companies. Known as the Unfair Claims Practices Act, these statutes empower policyholders to tackle instances of bad faith by insurers. When an insurer’s conduct raises suspicion, policyholders have recourse through state insurance regulators.

These rules require insurance firms to behave with integrity and deal justly with claimants. Knowledge of your entitlements under these laws provides a strong foundation for challenging any unethical behavior by adjusters.

The information provided in this section is for informational purposes only and does not constitute legal advice.

Reporting Unethical Behavior

If you experience improper conduct from an insurance adjuster, it’s your prerogative to complain. State-level departments that regulate insurance have the capabilities to deal with such matters. For example, in Utah, there is an Insurance Department Complaint Portal available for submitting grievances on the web.

By standing up against unethical behavior, you protect not only your own rights but also help ensure fairness for all insured individuals.

Navigating Communication with Adjusters

Maintaining calmness and professionalism during interactions with insurance adjusters is crucial for facilitating a fair settlement. Effective communication ensures the claim isn’t jeopardized and fosters a constructive relationship with the adjuster. When you need to negotiate with the adjuster for a fair outcome, clear and assertive communication is essential.

Clear communication also helps ensure the insurance company properly processes claims and avoids unnecessary delays.

Structured Communication Tips

If you choose to communicate with the insurance adjuster on your own, which we highly do not recommend then consider the following:

- Ascertain the identity of the person calling.

- Provide only basic personal information.

- Convey fundamental aspects of the event, including its location and time, while refraining from entering into specifics regarding the accident or any injuries sustained.

Keeping a written account during every interaction aids in maintaining precise details and serves as documentation of all exchanges.

Documenting Interactions

Maintaining a detailed log of every engagement with insurance adjusters is imperative. This habit provides precise documentation of discussions and resolutions, which becomes essential in the event of disagreements. Immediately jot down all details conveyed to and obtained from adjusters following each interaction.

Correspondence via written communication also creates an undeniable history of all exchanges. Such records may prove to be critical proof should it be necessary to advance your claim or contest the adjuster’s conduct.

Thorough documentation will help you present evidence if you need to dispute the adjuster’s decisions.

The Role of a Personal Injury Lawyer

Engaging the services of a personal injury lawyer can significantly influence the result of your injury claim. Hiring an experienced personal injury attorney ensures you have someone skilled in handling negotiations with insurance companies and maximizing your settlement. Such a legal professional safeguards you against forceful bargaining strategies and assists in steering through the intricacies involved in the legal system related to personal injuries.

Consulting an experienced lawyer can also help you navigate complex insurance disputes and counteract unethical tactics by adjusters.

A car accident lawyer can provide specialized expertise in dealing with insurance adjusters after a crash, ensuring your rights are protected and your interests are advocated for.

Legal Representation Benefits

Employing the services of a personal injury lawyer can be highly beneficial. The benefits include:

- Adding authenticity to your claim

- Assisting in gathering evidence that fortifies your case

- Offering expert legal protection during court proceedings, preventing errors while securing just compensation

- Personal injury attorneys are skilled in negotiating with insurance companies to secure the best possible outcome for their clients.

Lawyers who work on a contingency fee basis are driven to secure victory, often resulting in more substantial compensation or settlement proposals. Partnering with a law firm also lessens stress and burden by managing the intricate details of the legal process involved with personal injury cases.

Contingency Fee Basis

Attorneys specializing in personal injury typically provide legal services on a contingency fee basis, which allows clients to obtain legal representation without the burden of immediate expenses. Lawyers receive payment as part of the client’s settlement or judgment award rather than demanding fees beforehand.

Such an arrangement directly links the attorneys’ remuneration to achieving a positive result in their clients’ cases. Personal injury lawyers initially handle all litigation expenses and are reimbursed solely upon securing financial compensation for their clients. This model facilitates access to justice for individuals seeking redress for injuries, regardless of their economic situation.

Preparing Your Case

It is crucial to have a meticulously prepared case to maximize your insurance settlement. To do this, you should gather evidence such as photos, receipts, and police reports to support your claim. This requires collecting evidence and having a comprehensive grasp of your insurance policy to bolster your claim efficiently.

The more evidence you have, the stronger your case will be when negotiating with the insurance company.

Understanding your insurance coverage is essential to ensure you claim all the benefits you are entitled to.

Gathering Evidence

Gathering and arranging pertinent documents, such as medical records, police reports, statements from witnesses, and photographs documenting the injury or accident location, is critical to fortifying your case. Insurance companies employ formulas for assessing damages when formulating settlement proposals. These formulas consider the medical costs incurred and any degree of fault on the claimant’s part.

Your proof must encompass all forms of damages—economic and non-economic—and account for expenses incurred in the past, present, and anticipated future expenditures linked to the accident. It is also crucial to document damaged property and lost wages to ensure your claim is comprehensive. Adopting this thorough strategy aids in putting forward a compelling claim.

Understanding Your Insurance Policy

Grasping the nuances of your insurance policy is crucial. Knowing your policy limits is essential to ensure you do not exceed your maximum coverage and to understand what compensation you may be entitled to. Understanding the constraints and exceptions within your policy is vital, as your insurance provider may try to interpret policy terms in their favor, so be vigilant. Being informed about the extent of your coverage can make dealing with claim procedures much smoother.

When to Escalate Your Claim

Occasionally, if disputes arise and need to be settled, you might have to take your insurance claim to a higher level. Escalating your claim may be necessary to get a previously denied claim approved, especially if you believe the denial was unjust. This could mean contacting the state insurance regulators or even contemplating legal action to secure an equitable resolution.

Contacting State Insurance Regulators

Should an impasse arise that the insurance company’s grievance procedure fails to resolve, it is advisable to engage state regulatory bodies. Before initiating contact, gather all pertinent records and evidence.

State regulators overseeing insurance are tasked with assessing grievances and can initiate processes like mediation or comprehensive probes into the insurer’s conduct. Such supervision guarantees impartial handling of your claim.

Considering Litigation

The litigation process entails in-depth scrutiny of the insurance company’s records and rigorous cross-examination of its adjusters. Litigation may also focus on establishing liability and clarifying who is responsible for damages. These procedures are instrumental in illuminating any unclear terms within policy agreements and ironing out legal ambiguities.

Calculating Out of out-of-pocket expenses

In a personal injury claim, it’s essential to calculate all potential compensation accurately. This includes tangible costs like medical expenses, fixing property damage, and wages lost due to injury. Intangible non-economic losses such as emotional distress should also be accounted for. Calculating the true value of your claim is crucial to ensure you pursue maximum compensation and do not settle for less than you deserve.

Employing techniques such as the per diem method when estimating non-economic damages is critical for an inclusive assessment. Such meticulous calculations enhance your leverage during settlement negotiations.

Negotiating Settlement Offers

Avoid agreeing to the initial settlement offer during negotiations because it typically falls below what is justly due. Determine the lowest amount you would be willing to accept and modify your subsequent demands in response to the explanations provided by the insurance adjuster.

Insurance adjusters may try to pay less than you are owed, so it’s important to negotiate. Standing firm during negotiations helps you receive fair compensation. Engaging a personal injury attorney may scare insurance adjusters into making a better offer, since their involvement elevates the threat of legal action. Insurers are usually motivated by this increased risk to propose more equitable settlements. Accepting a low settlement offer too soon could cost you hundreds of thousands of dollars in lost compensation.

Free Consultation For Personal Injury Cases

A free legal consultation offers the following benefits:

- Comprehending your entitlements

- Evaluating how solid your case is

- Obtaining straightforward advice

- Gaining insights into the procedural aspects of law and the opportunity to seek legal counsel to maximize your chances of success

Leveraging a complimentary consultation can be an initial step towards attaining the remuneration you are rightfully entitled to.

Summary

In summary, dealing with insurance adjusters requires knowledge, strategy, and sometimes professional help. Negotiating with the insurance company, or insurer, is crucial to protect your rights and ensure you are not taken advantage of during the claims process. You can protect yourself from unfair practices by understanding adjuster tactics, knowing your rights, and communicating effectively. Hiring a personal injury lawyer can further enhance your chances of a fair settlement.

These strategies are especially important for those involved in car accidents, where insurance company tactics can significantly impact your compensation.

Remember, you don’t have to face this challenge alone. Stand firm, know your rights, and seek the help you need to ensure justice is served. Your journey to fair compensation is within reach.

Frequently Asked Questions

What tactics do insurance adjusters use to minimize payouts?

Insurance claims adjusters might employ strategies that include urging claimants to finalize settlements swiftly, casting doubt on the extent of injuries sustained, and carrying out surveillance to collect evidence that could be used to challenge the claimant’s case.

Individuals facing these tactics must recognize them and consider obtaining legal counsel if needed.

How can I protect myself from pressure tactics used by insurance adjusters?

To protect yourself from pressure tactics, set clear boundaries, avoid detailed discussions, and refrain from quick settlements until you fully assess your claim’s value.

Stay confident in your decision-making.

What should I do if an insurance adjuster questions the severity of my injuries?

Obtain comprehensive medical records to substantiate your injury claims, and refrain from providing in-depth accounts immediately following the accident.

Doing so will bolster the legitimacy of the injuries you report as being severe.

How can a personal injury lawyer help in dealing with insurance adjusters?

An experienced lawyer specializing in personal injury can safeguard you from forceful negotiation strategies, support the gathering of proof, and offer legal counsel. This often leads to receiving higher compensation or settlement proposals.

Engaging with an experienced lawyer who is a specialist in personal injuries relieves the pressure of interacting with insurance representatives and bolsters your likelihood of securing just remuneration.

When should I consider escalating my claim?

Should negotiations break down, or you face unscrupulous conduct from the adjuster, taking your claim to a higher level is necessary.

In these circumstances, contacting state insurance regulators may be required, or even taking legal action might become an option worth considering.